Printing Money, Quantitative Easing, Money Supply and Currency in Circulation— how do they relate? Today we are looking at an excellent explanation on the FED’s money printing process by James Hamilton, economist of the University of California, San Diego. Did the Federal Reserve really print a Trillion dollars in their Quantitative Easing program? Did that increase the money supply by a Trillion dollars? He presents some interesting charts on currency in circulation versus currency reserves. Tim McMahon, editor

Money and Reserves

I wanted to offer some clarification on stories about all the money that the Federal Reserve is supposedly printing. It depends, I guess, on your definition of “money.” And your definition of “printing.”

When people talk about “printing money,” your first thought might be that they’re referring to green pieces of paper with pictures of dead presidents on them. The graph below plots the growth rate for currency in circulation over the last decade. I’ve calculated the growth rate over 2-year rather than 1-year intervals to smooth a little the impact of the abrupt downturn in money growth in 2008. Another reason to use 2-year rates is that when we’re thinking about money growth rates as a potential inflation indicator, both economic theory and the empirical evidence suggest that it’s better to average growth rates over longer intervals.

Currency in circulation has increased by 5.2% per year over the last two years, a bit below the average for the last decade. If you took a very simple-minded monetarist view of inflation (inflation = money growth minus real output growth), and expected (as many observers do) better than 3% real GDP growth for the next two years, you’d conclude that recent money growth rates are consistent with extremely low rates of inflation.

Two year growth rate (quoted at annual percentage rate) of currency in circulation. Data source: FRED.

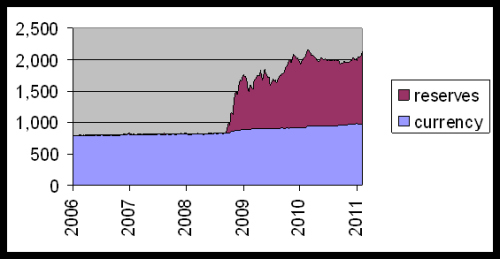

But if the Fed didn’t print any money as part of QE2 and earlier asset purchases, how did it pay for the stuff it bought? The answer is that the Fed simply credited the accounts that banks that are members of the Federal Reserve System hold with the Fed. These electronic credits, or reserve balances, are what has exploded since 2008. The blue area in the graph below is the total currency in circulation, whose growth we have just seen has been pretty modest. The maroon area represents reserves.

Currency in circulation (blue) and reserve balances with Federal Reserve Banks (maroon), in billions of dollars

Are reserves the same thing as money? An individual bank is entitled to convert those accounts into currency whenever it likes. Reserves are also used to effect transfers between banks. For example, if a check written by a customer of Bank A is deposited in the account of a customer in Bank B, the check is often cleared by debiting Bank A’s account with the Fed and crediting Bank B’s account. During the day, ownership of the reserves is passing back and forth between banks as a result of a number of different kinds of interbank transactions.

To understand how the receipt of new reserves influences a bank’s behavior, the place to start is to ask whether the bank is willing to hold the reserves overnight. Prior to 2008, a bank could earn no interest on reserves, and could get some extra revenue by investing any excess reserves, for example, by lending the reserves overnight to another bank on the federal funds market. In that system, most banks would be actively monitoring reserve inflows and outflows in order to maximize profits. The overall level of excess reserves at the end of each day was pretty small (a tiny sliver in the above diagram), since nobody wanted to be stuck with idle reserves at the end of the day. When the Fed created new reserves in that system, the result was a series of new interbank transactions that eventually ended in the reserves being withdrawn as currency.

All that changed dramatically in the fall of 2008, because (1) the Fed started paying interest on excess reserves, and (2) banks earned practically no interest on safe overnight loans. In the current system, new reserves that the Fed creates just sit there on banks’ accounts with the Fed. None of these banks have the slightest desire to make cash withdrawals from these accounts, and the Fed has no intention whatever of trying to print the dollar bills associated with these huge balances in deposits with the Fed.

Of course, the situation is not going to stay this way indefinitely. As business conditions pick up, the Fed is going to have to do two things. First, the Fed will have to sell off some of the assets it has acquired with those reserves. The purchaser of the asset will pay the Fed by sending instructions to debit its account with the Fed, causing the reserves to disappear with the same kind of keystroke that brought them into existence in the first place. Second, the Fed will have to raise the interest rate it pays on reserves to give banks an incentive to hold funds on account with the Fed overnight.

Doing this obviously involves some potentially tricky details. The Fed will have to begin this contraction at a time when the unemployment rate is still very high. And the volumes involved and lack of experience with this situation suggest great caution is called for in timing and operational details. Sober observers can and do worry about how well the Fed will be able to pull this off.

But that worry is very different from the popular impression by some that hyperinflation is just around the corner as a necessary consequence of all the money that the Fed has supposedly printed.

Reprinted by Permission. Original Article

We used to wonder if the dollar had any gold backing. Now we wonder is the Fed’s electronic entries have any dollar backing. It appears not. The financial system is an electronic creation. Somebody should pull the plug.