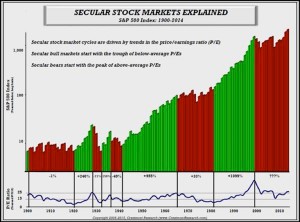

In today's article John Mauldin looks at the "Big D" deflation plus the difference between the out look and time-frame of the average investor and that of the professional money manager. He also looks at the difference between "secular" and "cyclical" bull and bear stock markets. We also have an article by Jawad Mian entitled "A Little Less Deflation, A Little More Reflation, Please". Enjoy! ~ Tim McMahon, editor Thoughts from the Frontline: World War D—Deflation By John Mauldin Everywhere I go I’m asked, “Will there be inflation or deflation? Are we in a bull or bear market? Is the bond bull market over and will interest rates rise?”The flippant answer to all those questions is “Yes.” … [Read more...]

What is the Economy Usually Doing When Gold Goes Up?

Traditionally when does Gold rise and when does it fall? What economic indicators predict gold prices? In this article Robert Prechter looks at the economy and Gold Prices. ~ editor By EWI President Robert Prechter ...If gold isn’t going up when the economy is contracting, when is it going up? Table 4 (see chart on p. 24 of this free Club EWI report ~ editor) answers the question: All the huge gains in gold have come while the economy was expanding. This is true of the three most dramatic gold gains of the past century: (1) Congress changed the official price of gold from $20.67 to $35 per ounce in 1934, during an economic expansion. The gain against the dollar was 69 … [Read more...]