People often confuse Deflation and Depression perhaps because in the 1930s the U.S. experienced a lot of both of them at the same time. This combined with the similarity in the sound of the words tends to compound the confusion. But they are not synonymous, it is quite possible to have an inflationary depression as the Hyperinflation in Weimar Germany from 1919-1923 shows.

Just as inflation is more than just rising prices, deflation is more than just “falling prices”. In both cases, the terms “inflation” and “deflation” actually refer to the macro “cause” while the change in prices is simply the “effect”. Unfortunately, lazy speech tends to confuse the “cause” with the “effect”. So when referring to more than just falling prices, for clarity it can be referred to as “debt deflation” as debt i.e. Corporate Bonds feels the effects the most because they must be repaid by ever more valuable money, while during an inflation debt is repaid with “cheaper dollars”.

Although most people won’t object to falling prices, runaway deflation can be as devastating as hyperinflation to an economy. In the following article, the editors of Elliott Wave International look at the 5 countries most at risk for runaway deflation today. ~Tim McMahon, editor

Severe Debt Deflation: Why These 5 Nations Are Most at Risk

“The private sector feels the urge to deflate its debt more acutely than the public sector”

By Elliott Wave International

Debt deflation is devastating. It’s also rare.

The world experienced a brush with it when the subprime housing market imploded about 12 years ago.

Before that, the last all-out deflation was in the early 1930s — commonly known as the “Great Depression.”

Before delving into the nations most at risk for a severe debt deflation today, let’s do away with the common misconception that says deflation is just falling prices.

The actual definition is that deflation is a contraction in the volume of money and credit relative to available goods. Falling prices do occur during deflation, but they are simply an effect.

In other words, as Robert Prechter’s 2020 edition of Conquer the Crash, notes:

When the volume of money and credit falls relative to the volume of goods available, the relative value of each unit of money rises, making prices of goods generally fall. Though many people find it difficult to do, the proper way to conceive of these changes is that the value of units of money are rising and falling, not the values of goods.

Deflation requires a precondition: a major societal buildup in the extension of credit and the simultaneous assumption of debt.

Here in 2020, this precondition has been mostly met.

Also, keep in mind, it’s private-sector debt that we need to focus on most in a debt-deflation because the private sector cannot print money to service the debt, as Murray Gunn, EWI’s Head of Global Research, recently noted.

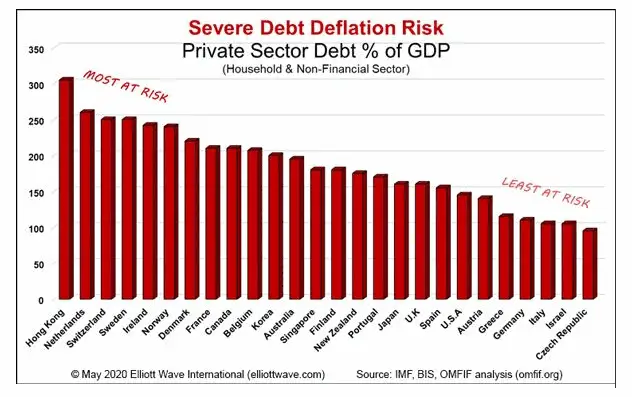

With that in mind, Elliott Wave International’s June Global Market Perspective, a monthly publication which covers 40-plus worldwide markets, showed this chart and said:

The private sector feels the urge to deflate its debt more acutely than the public sector, not to mention that lower credit quality in the private sector deflates debt via defaults.

If we strip out government debt and just look at the private sector, the chart shows [that] Hong Kong, the Netherlands, Switzerland, Sweden, and Ireland are the five countries most at risk of a severe debt deflation.

If this calculation included the financial sector, the U.S. would be further up the “at-risk” scale.

And, of course, those who live in the countries “least at risk” should also prepare for a severe global debt deflation.

One way to prepare is to make sure you have plenty of cash on hand.

Returning to the June Global Market Perspective:

For corporations and for individuals alike, the ultimate shelter in a storm is cash. Cash is liquid, and in deflation, its value goes up as other asset and good values go down.

*****

This is an ideal time to tap into more of EWI’s global analysis, and you can do so free via the valuable resource, 5 Global Insights You Need to Watch.

EWI’s top global experts share their latest forecasts for cryptocurrencies, crude oil, interest rates, deflation, and the future of the European Union.

The result is a short, 5-video series (plus, two quick reads). In just 13 minutes, you get insights into markets and factors that can have a major impact on your investments.

These 5 videos and 2 excerpts are from EWI’s Global Market Perspective. It’s premium, subscriber-level data.

And — you can get it free with a quick Club EWI signup. Club EWI is the world’s largest Elliott wave educational community and membership is also free.

Follow this link: 5 Global Insights You Need to Watch — free, subscriber-level content.

- The Great Depression and the Deflationary 1930′s– 1930-1939

- What is Deflation?

- What is Hyperinflation?

- What is Stagflation?

- What Is Fiat Currency?

Leave a Reply