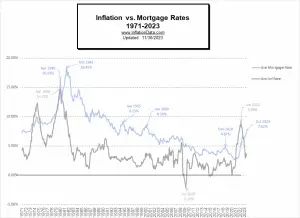

The interesting thing about borrowing money long-term is that inflation actually helps you repay the loan with cheaper money... At 7% inflation, prices double roughly every 10 years, which is only 1/3rd of the way through your 30-year mortgage. So, if your budget was stretched initially to make your mortgage payment, after 10 years (assuming your salary kept up with inflation) that same mortgage would only have half the impact on your budget. Thus, to get the true impact of mortgage rates, we need to adjust them for inflation. It has been a while since we addressed the issue of “Inflation Adjusted Mortgage Rates,” primarily because inflation and mortgage rates have been at historically … [Read more...]

How Much Has Inflation Affected Mortgage Rates in the Last 5 Years?

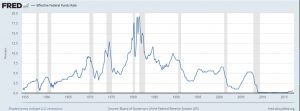

In some ways, mortgage rates are a reflection of the overall health of the American economy. As we can see in the chart below from "FreddieMac", often both mortgage rates and inflation rates peak during recessions and tend to fall or are stable during better times. How has inflation impacted mortgage rates recently? The FED Rate According to the St. Louis FED website: "The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with … [Read more...]

30 Year Fixed Rate Mortgages, Nope Not at 3.25%!

Fixed Rate Mortgages So is it true 30 year fixed rate mortgages are at 3.25%? Well that depends on how you look at. The answer is yes if you willing to invest discount points to purchase your interest rate down, so long as your financial profile is completely flawless. Otherwise for the 99.9% us, 30 year mortgages are trailing between 3.5% to 4.25%. That's been the reality of the mortgage bond market over the last few weeks since the 30 year fixed rate mortgage hit an all-time record of 3.53% on July 19, 2012. 30 year mortgage rates you see on television and the internet are not the best barometer of where rates truly are... Here's why: the bond market is moving all day long in … [Read more...]