Why You Should Care About DJIA Priced in Gold

By Vadim Pokhlebkin

The following article is provided courtesy of Elliott Wave International (EWI). For more insights that challenge conventional financial wisdom, download EWI’s free 118-page Independent Investor eBook.

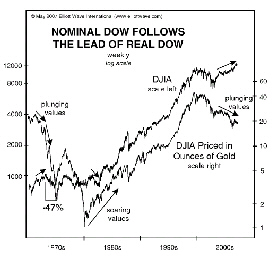

Of the many forward looking market indicators we at EWI employ, one of the most interesting tools (and least discussed in the financial media) is the Dow Jones Industrial Average (DJIA) priced in gold — “the real money,” as EWI’s president Robert Prechter calls it.

We’ve been tracking the Dow/Gold ratio for many years and it has served our subscribers well. It’s not a short-term timing tool, yet in the longer term, as our January 6 Short Term Update put it, “the nominal Dow eventually plays catch up to what is transpiring in the Dow/Gold ratio.”

Here’s a good example. Remember when the nominal Dow Jones Industrial Average hit its all-time high? October 2007, just above 14,000. At that time, most investors expected new highs still to come. But our Elliott Wave Financial Forecast warned five months prior, in May 2007:

One key reason [for a coming top in the DJIA] is the undeniable bear market status of the Dow Jones Industrial Average in terms of gold, the Real Dow…

Notice, by contrast, the relative strength of the Real Dow versus the nominal Dow, the index in terms of dollars, from 1980 to 1982. By August 1982 when the Dow denominated in dollars bottomed, the Real Dow was rising strongly from its 1980 low… The nominal Dow soon played catch-up, and they both rallied more or less in sync until 1999.

Notice, by contrast, the relative strength of the Real Dow versus the nominal Dow, the index in terms of dollars, from 1980 to 1982. By August 1982 when the Dow denominated in dollars bottomed, the Real Dow was rising strongly from its 1980 low… The nominal Dow soon played catch-up, and they both rallied more or less in sync until 1999.

Now, instead of soaring the Real Dow is crashing relative to the nominal Dow. In fact, it’s barely off its low of May 2006. This dichotomy reveals the weakness that underlies the financial markets’ push higher. When mood turns and credit inflation reverses, the ensuing drop in the nominal value of the market should be dramatic.

“Dramatic drop” did indeed follow: Between October 2007 and March 2009, the DJIA lost 53%, high to low.

For more information, download Robert Prechter’s free Independent Investor eBook. The 118-page resource teaches investors to think independently by challenging conventional financial market assumptions.

Vadim Pokhlebkin joined Robert Prechter’s Elliott Wave International in 1998. A Moscow, Russia, native, Vadim has a Bachelor’s in Business from Bryan College, where he got his first introduction to the ideas of free market and investors’ irrational collective behavior. Vadim’s articles focus on the application of the Wave Principle in real-time market trading, as well as on dispersing investment myths through understanding of what really drives people’s collective investment decisions.

Leave a Reply