By Jared Dillian I was watching the 6 o’clock news and saw images of closed banks in Greece and people lined up at ATMs. I’m sure you did, too.This must seem surreal to most people because it seems so remote. But put yourself in these people’s shoes for a second. You have money in the bank. Suddenly you can’t get to it. After standing in long lines, you can only get 60 euros at a time, which isn’t going to last you very long. What if you didn’t plan adequately and haven’t stashed away any cash? The banks will be closed for a while. What happens? How do you pay for rent? Or food? How does your employer pay you? Do you go homeless? Or hungry? Do you get really angry, take … [Read more...]

Where is Gold Headed?

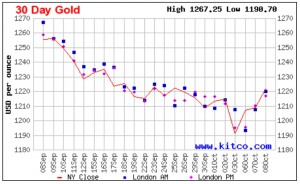

This week has been tumultuous for the markets with steep market drops and subsequent rallies. Over the last month gold has been as high as $1260 subsequently it fell steadily to $1190 for a 5.5% drop. But then gold bottomed near $1190 and as of this writing it has risen above $1220 for a 2.5% rally in a couple of days. So what does that mean for the price of gold? Is it doomed or is the bottom in and we are seeing bargain prices? This week two of our favorite commentators Casey Research and Elliott Wave International have both jumped into the discussion and I present their views here. ~ Tim McMahon, Editor Gold: Time to Prepare for Big Gains? By Casey Research Years of … [Read more...]

Where is Gold Headed?

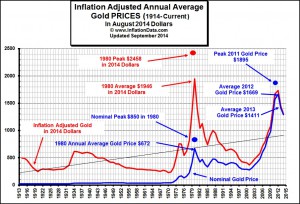

To get the true measure of anything it is important that you use a standardized measurement. This of course is why a "foot" or "inch" eventually became exactly a certain length and didn't vary based on each particular person doing the measuring. And more recently it is why Celsius measurement relates to the exact freezing and boiling points of water at an exact atmospheric pressure. It is also why, when we measure a commodity like Gold or the stock market we need to use a scale that doesn't change. Unfortunately, the typical measurement i.e. the U.S. dollar is always changing in value. That is the dollar depreciates due to inflation thus changing the measurement on a daily (or at least … [Read more...]

Oil, Petrodollars and Gold

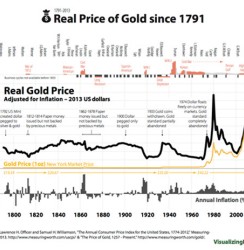

For thousands of years gold has been synonymous with money, albeit with periods where governments mandated other mediums of exchange. Therefore, throughout history prices were measured in gold rather than in dollars, Rubles or Yen. By looking at the chart to the right you can see the current price of gold over the last 24 hours in terms of dollars. As of this writing it is $1256.70 per troy ounce but gold has fallen from its monetary pedestal and now fluctuates just as other commodities. The Fall of Gold and Rise of the Dollar Shortly after assuming office in 1933, President Franklin Roosevelt perpetrated one of the greatest frauds ever on the American public. He knew that the … [Read more...]

Is It Time to Admit That Gold Peaked in 2011?

By Jeff Clark, Senior Precious Metals Analyst Have you seen this “real price of gold” chart that’s been making waves? Among other things, it purports to show the gold price adjusted for inflation over the past 223 years. Notice the 1980 vs. 2011 levels. The chart makes it seem that on an inflation-adjusted basis, gold has matched its 1980 peak in 2011, or nearly so. A mainstream analyst who still thinks of gold as a “barbarous relic,” a government official who doesn’t want people to think of gold as money, or an Internet blogger looking for some attention might try to convince you that this proves that the gold bull market is over, arguing that the 2011 peak of $1,921 is the equivalent … [Read more...]

A Reader Question About IRAs and Gold Stocks

I recently got an excellent question from a longtime reader named Bob and I thought I would pass along some of what I told him. Bob has invested a good portion of his IRA in shares of Randgold Resources. The NASDAQ symbol is GOLD. Randgold Resources is a gold mining business based primarily in Mali. Its headquarters are in Jersey, the Channel Islands, it is listed on the London and the NASDAQ stock exchanges. Bob has been accumulating shares of Randgold because he feels that as a mining company it is a productive asset rather than physical gold (or paper derivatives of gold) which earns no interest (or dividends). Randgold peaked at around $127 back in October 2012 and has been trending … [Read more...]

The Case of the Disappearing Gold

When I was in the 6th grade (many, many years ago) my class took a field trip to New York City and visited the NY FED. The highlight of the trip for me was a ride down the elevator (or more precisely what was at the bottom. The ride took forever with dozens of kids and one security guard in that tight stuffy space. Anticipation built as we went down what seemed like miles into the earth where the vaults rested on Manhattan bedrock. And what was in those vaults? Gold! Lots of gold! Each vault had a name on it but not people's names, countries names. After all in those days people weren't allowed to own gold. For years now there has been a controversy as to whether our (the U.S.) Gold … [Read more...]

2 Types of Money

From the beginning, productivity improved with specialization. If one person can produce fruit more efficiently while the other was a better hunter, more wealth will be generated if the hunter hunts and the farmer farms. Forcing the farmer to hunt or the hunter to farm is just plain inefficient. But in order for the system to work there has to be a medium of exchange. Somehow the farmer has to be able to get the wild game in exchange for his crops. And what if the farmer wants meat but his crops aren't ripe yet? Well, that is how credit developed. In today's post Bill Bonner looks at mediums of exchange i.e. money and credit. He examines how they began and what they mean for us and our … [Read more...]

Buying or Selling Gold and Silver?

Many investors consider the recent drop in gold, silver and platinum prices to be the perfect opportunity to build (or add to) their precious metals position. With the price down, the basic law of supply and demand has kicked in and demand for silver bullion and silver coins has risen sharply. Short-term, supply has gotten tight, as some dealers scramble to keep up with demand. We also saw a major disconnect between Physical Gold vs. Paper Gold as a massive sell order hit the futures market to sell 400 tons of gold! But at the same time small buyers rushed to their local dealer to take advantage of the price drop and stock up on the physical metal. And of course since gold and silver … [Read more...]

Gold Mining Stocks are Down – What’s Up?

For many years now I've been saying that Gold is a Crisis Hedge rather than an inflation hedge. But it is also a commodity and a monetary instrument. Thus there are a variety of factors affecting its price at any given time. Currently as the world economy continues rolling on people are less worried about catastrophe around the corner and they are beginning to believe that the FED is all powerful and can paper over any and all monetary problems with the stroke of a pen. So why worry? This has taken some of the edge off the urgency to buy gold. Plus as the stock market reaches new highs the "opportunity cost" of holding gold increases. So does this mean that gold is headed for the dustbin and … [Read more...]